Update

January 31

Specialists from xpd global comment on the impact of delays and increases in tariffs on imports and exports.

The crisis in the Red Sea has directly impacted transit times and shipping costs globally.

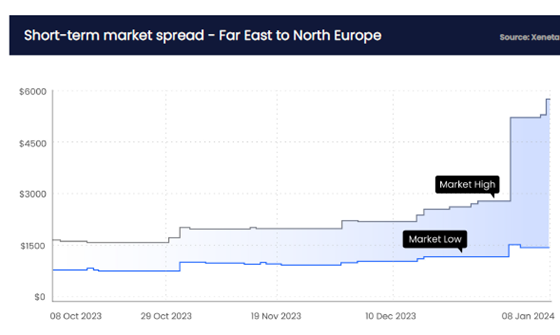

Rates have almost quadrupled between October 8, 2023 and January 8, 2024 on routes from the Far East to Northern Europe, according to data from specialized consultancy Xeneta.

We have interviewed Dora Chang, North America Sourcing Director at xpd global to understand what we could expect from the international transport outlook in the short, medium, and long terms.

Regarding rates, Dora brings good news and highlights that the Chinese New Year (CNY) must be a focal point of attention right now.

“The most reliable market sources are not making straightforward comments on how much rates will rise, but it is unlikely to reach the same levels seen during the pandemic. There will be surcharges before CNY and after, and uncertainty they will remain as the Red Sea Conflict is unresolved”, she states.

“It is also unlikely to see pre-crisis levels after CNY – due to the extra operation cost and fuel due to the changes in routings and equipment imbalance – however, we could expect some level of softening in rates”, expects the specialist.

In addition to the cost impact, the ongoing crisis in the Red Sea has led Maersk and several other shipping companies to divert their container ships, opting to sail around the Cape of Good Hope in South Africa.

This choice has led to disruptions in port schedules, less container availability, and an increase in operating costs due to the additional transit time required for rerouting. Nevertheless, Mrs. Chang brings us at least some relief:

“Yes, we are seeing container shortage in some regions, but it is unlikely to see congestion at port. In North America, we will still see about the same levels, perhaps 15%-20% less from the current on the imports during 1Q2024 in key trades. For customers, it will be key to secure their allocations with planning ahead. Due to the equipment imbalance, export rates to Far East and Europe will be softening.”

xpd global recommends

We understand the drain caused by frequent disruptions. Circumstances can rapidly escalate beyond your control. As your strategic logistics partner in time-sensitive services and time-critical solutions, we recommend you at this time:

Maintain close contact with your xpd global executives to learn about route changes and the alternatives available.

“Air freight options – especially Time Critical Cargo solutions – can definitely be used to avoid line stoppages, but you should also talk to your xpd global executives about multimodal plans and the possibility to consolidate your ocean freight (LCL)”, advises Mrs. Chang. “In North America, routing via Seattle/Tacoma or Vancouver/Prince Rupert will become more attractive, combining ocean services with transloading and over-the-road domestic solutions”.

Do you need a freight transport plan tailored to your needs? Contact us now.

We are xpd global | the fastest logistics experience.

Update

January 11

Yesterday (Tuesday 10), Houthi militias launched the biggest attack on merchant vessels in Red Sea, the 26th since Nov. 19.

As your strategic partner in logistics, today we’d like to reiterate two previous recommendations and add a couple more:

- Consider changing your plans to using Air Freight Services, specially for time-sensitive and time-critical

- Work closely with your finances team to assess extra costs related to surcharges and raise in overall rates.

- Prepare your teams to negotiate spot rates at least during 1Q2024 – xpd global executives around the world can help you that.

- Trust only in reliable sources to make the best data-backed decisions.

Contact our teams now to understand the changes in your logistics plans and designed tailored alternatives.

Update

January 10

As your strategic partners in logistics, our teams in xpd global have been actively monitoring the current situation on the Red Sea region and its impact on international trade and freight transport.

Leading ocean freight companies are organizing re-routing strategies to ensure its resources and seafarers security. Maersk, MSC, Wanhai, Hapag-Lloyd, ONE, YML, and HMM, have stopped sailing through the Red Sea and route ships around the Cape of Good Hope instead, which shall lead to an increase in costs and transit times (TT).

Transit Times are not guaranteed as routing options and ETAs for the ports are changing by the hour.

Our commitment to you as xpd global has always been a flexible logistics partner dedicated to design tailor-made solutions to avoid disruptions in your supply chain, and we keep our word.

Our recommendations at this time are:

Route and transport mode diversification

Evaluate the shipping routings and deviations. Air option is highly recommended for time-critical and time-sensitive shipments.

Time and cost management

Anticipate delays and assess the financial impact.

Our teams are at your disposal to listen and understand how the situation at the Red Sea is impacting your business and present alternatives that can ensure your peace of mind.

Routes from/to North America

Transit times: Compared with the Suez routing, re-routing via the Cape of Good Hope would add 7 to 10 days of transit time for the USEC sailings from South Asia origins.

For the sailings which originally routed via the Panama Canal, especially from Central/North China origins, the diversion to the Cape of Good Hope would see longer transit time with a delay of 2 to 3 weeks.

Rates: All shipping lines have announced rate increases as below:

- MSC has announced a contingency surcharge

- CMA has announced a surcharge since 01 Jan 2024

- Hapag Lloyd has deployed an Operational Recovery Surcharge (OCR), a shuttle service to connect Red Sea Cargo and they have postponed the Contingency Surcharge (CSU) for shipments from North Europe & Mediterranean to Canada, the US and Mexico to February

- Maersk has announced a Transit Disruption Surcharge (TDS), a Peak Season Surcharge (PSS) and an Emergency Contingency Surcharge (ECS).

- Cosco has announced a rate increase from 01 Jan 2024

- Evergreen has also increased rates

Please contact your xpd global account executive to learn the exact increases related to your shipments.

Recommendations: Please talk to our teams about the possibility to rely on transloading services using the USWC. xpd global USA is fully capable to manage them in Los Angeles/Long Beach as well as Seattle, which can avoid using Panama Canal and Cape of Good Hope saturated routing.

Routes from/to Europe

Trustworthy news channels and agencies have been gathering specific data on several points of impact. This is a quick summary of last days’ main highlights:

- The journey around Africa takes about 10 days more (over 20% TT increase). Source: BBC

- Freight costs have increased up to 3x in some routes. Sources: EFE + CNBC

- The route between East Asia and the Mediterranean cost USD 2,401 per container a week ago, now costs USD 5.640 (Up 115%).

- Freight costs from China and East Asia to northern Europe through the Suez Canal went from USD 1,590 to USD 4,274 between Dec. 29 and Jan. 5.

- Rates from northern Europe to eastern Asia rose 142% (from USD 312 to USD 756) in the same period. | Rates from Mediterranean ports to China or East Asian countries raised from USD 169 to USD 569 (237% more).

- LinkedIn News has been publishing timely updates on the decisions made by global companies.

Contact us now to learn more about how our solutions can offer more value to your current operations.

Be sure that we’ll keep on monitoring updates from the most reliable sources and following our current operations with your company close by.